You are here

Revolutionary New Risk Assessment Model

FMI have formulated a revolutionary Risk Assessment Model that is based on fully understanding the role an individual plays within a business.

FMI's new model has moved away from the traditional approaches in the insurance industry in that it distinguishes between salaried and self-employed individuals. In the case of self-employed individuals, it also assesses risks based on the role that these individuals play within the business rather than their underlying occupation. This new approach enables FMI to more accurately assess the risks presented by self-employed clients and to recognise and reward these individuals accordingly.

Self-employed

This is a broad term used to describe business owners, self-employed professionals and variable income earners. Traditional risk assessment models usually classify these individuals based on their underlying occupational risks, with adjustment for the splits between administration, supervisory, manual and travel duties. The reality is that using the underlying occupation as a starting point for assessing risk in this market is inherently flawed.

At FMI we acknowledge and understand the vastly different roles a business owner can play within their business and how this differs with each individual case. We also understand that in many cases, the individual is no longer practising in their underlying occupation, and that the disability risks presented cannot be rated by reference to standard occupational risks. Our claim experience has shown us that there is a unique behavioural psychology associated with the self-employed market that traditional rating models do not recognise.

By making a few minor changes to the risk assessment questions we ask at quotation stage, FMI is now able to segment self-employed individuals into one of three basic classifications. These describe the role that the individual actually plays in the business, creating a sound platform for more accurate assessment of the disability risk presented.

Business owner

An individual will be classified as a business owner if their contribution to production of income is limited and their role is strategic and managerial in nature.

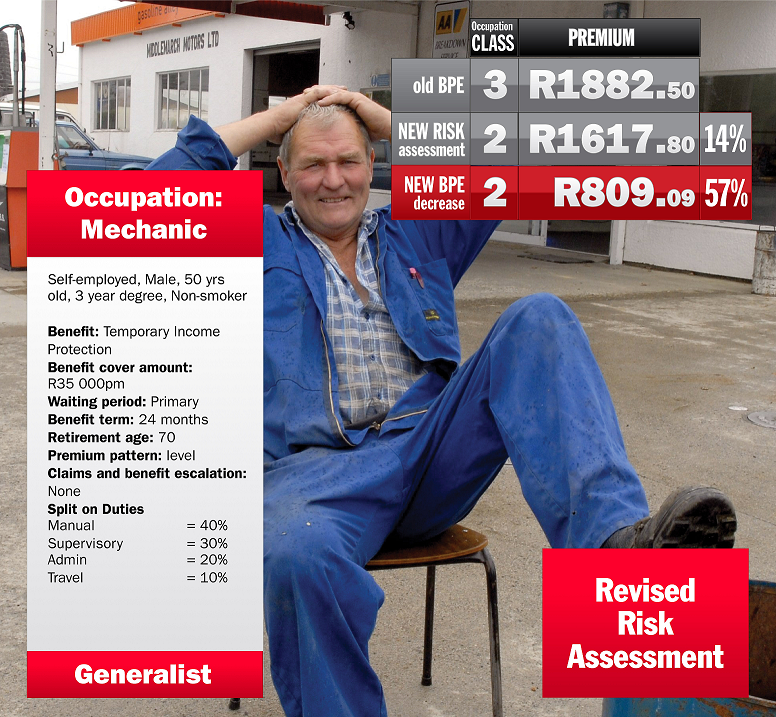

Generalist

If a self employed individual is involved in all activities within the business, management and production, they will fall into the generalist category.

Specialist

An individual whose primary role is contributing to the production side of the business and who possesses a skill to provide superior quality or service is a specialist.

We will combine this classification with standard information about the duty splits of the individual and some further qualitative key-person profiling information. This will enable us to arrive at a more accurate and complete picture of the role that the individual plays within the business, and decipher the extent to which the business is dependent on the continued contribution of the individual.

Advantages of the New Risk Assessment Model

- Detail of profile allows for accurate quotes and minimum underwriting corrections

- Appropriate self-employed classification resulting in improved rates for business owners

- Accurate rates: claims experience improves as it is aligned with the risk premium

- Recognises and rewards the unique behavioural characteristics in the self-employed market

This revolutionary way of looking at risk bears the needs of clients and Financial Advisers in mind. Ultimately a better risk assessment upfront helps provide additional certainty at claim stage. Make sure your clients are covered by the Income Protection Specialists.

We have included a REAL LIFE example below that you can run through with your clients to illustrate our enhancements:

- Log in to post comments